Although today, most transactions take place through online transaction systems, most parts of the globe still use checks. In this article, we will go through its different forms and how you can quickly write the check step by step.

History of check

Checks have existed for many years, but do you know exactly about the first check introduced? The first check was made in the 17th century, 1762 by British banker Lawerance children. Some studies show that the checks were introduced roughly 200 years ago with the advent of the Bill of Exchange. Undoubtedly, many methods are introduced in the modern age, but checks are not completely demised. Check is actually:

“the piece of paper or bill that you order the bank to transfer the money to you or your other party’s bank account.”

What are the Different Types of Checks?

Checks have been used for many years. But are all the checks the same? No, many types of checks are present for different types of checks.

Bearer Check:

The bearer check is the safest type of check that is issued to you by the bank. In this type of check, you order the bank for the payee, and they pay you like it is the check you carry to the bank on every month’s first date to withdraw your salary or pay. This check is paid to the person whose name is printed on the front or who carries the check.

Order Check:

This is the second type of check-in list. The bearer and order check are the same but slightly different. in the case of a bearer check, the bank needs that person’s identity, but the check bank doesn’t require any verification of the check carrier or bearer.

Crossed Check:

This check is also considered a safety check because it can only be cashed at the payee bank. In crossed check, the person who issues the check must write the a/c payee along with the parallel bent line on the top left corner.

Through this form of a check, the payment is only transferred to that particular organization or person whose name is mentioned as the payee.

Open Check:

This is also an uncrossed check, as it has no crossed lines. Also, this check can be cashed at any bank if you made a payment to someone through an open check, then he/she can cash that check either in his bank branch or at the same branch as the check was. The payees can also use it as a payee for another person. This check requires you to sign it on both sides, front and back.

Post-Dated Check:

It is the kind of check issued for a specific date, or you may say that before the date. The bank will never make payment to payees until that date has on. Simply put, this check can be cashed after the date mentioned.

Stale Check:

The type of check is quite old in its issued date. Usually, a 6- to 3-month check is considered a stale one. The duration may vary in business terms. In short stale is the check that passed its validity date.

Traveler’s Check:

This check doesn’t have an expiry date. It is used mainly by travelers as it can be cashed in any other country from your country in any bank branch and also in that country’s currency.

Self-Check:

Self-check, as obvious by its name, is the check for yourself through this check. They can cash checks for themselves. This check has the word “self” as the payee place. The bearer and self-check do not need identification from the bank.

Banker Check:

The banker check has a limitation or validity until three months. It is the kind of check issued to the person within the city to another person by the account holder, but the bank itself will assign the statement.

Blank Check:

You may have heard about this check before. It is the kind of check signed by the account holder or drawer to the organization or person without the mentioned amount. This check will only contain the signature.

Note: payees is the person or organization who received the payment or amount.

What are the methods or ways to write checks correctly?

After discussing the types of checks, let’s check how you can properly and correctly write or sign the check and what you should write to make it acceptable for the bank.

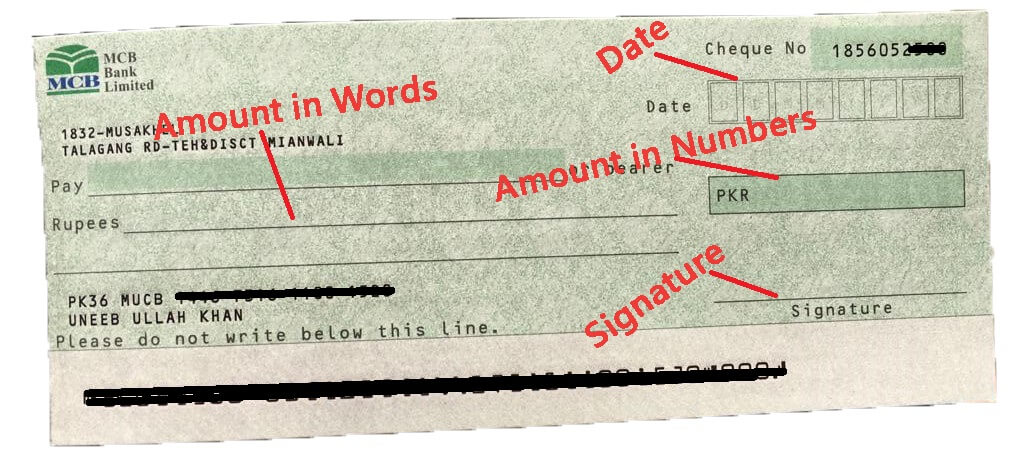

Date section:

The first and most important part you write is the date, month, and year. This section is located in the top right corner of the check. It is important as a bank must have a record of when you withdraw money or write a check.

To whom this check is for:

The very next step is to write the person’s name or organization name to which you will make payment. Some bank allows you to write the word “cash,” but losing the check is pretty risky.

Amount in numeric and words:

There are two portions or sections where you must write the proper and valid amount and know the range of your account balance before mentioning the amount. In one section where the box is mentioned, you must write the amount clearly in numeric form, and on the bar where the term is mentioned, “write the amount in words,” write the same amount in words.

Signature:

A signature is the most important part of the check it shows that you agree to the information mentioned above and consent to pay the amount or withdraw. The signature must be the same as you mentioned on the form when opening the account.

The instructions you must follow while writing the check:

- Write down all the words and digits.

- Write the word or phrase “only” at the end while writing the check in words.

- Avoid cutting or overwriting.

- Mentioned the correct amount and date.

- Write the date according to the mentioned format on the check.

- Use the same signature each time you write a new check.

- Write all the fields and re-check before submitting it.

What is the safest way to write a check?

You must follow some precautions while writing the check. It is important to save your account balance. Always write the check with the pen, which is hard to remove. Fill in the data and name of the receiver before signing the check. Most importantly, it doesn’t leave extra space or room in the amount area, especially in the numeric amount section.

How to Write a Legal Check? (Updated 2023)

Follow the instructions then you will be able to write a legal/perfect check, and no one will reject this:

- Enter the date (Write a date that you want to withdraw)

- Write the amount in numbering (Example: $1000)

- Write the amount in words (English or any local language) (Example: One Thousand Dollars Only)

- Write a one-time Signature on the front and two times on the back of the check.

Hope you got it. Here we mentioned an image of a local check example where you can easily understand this!

Final Verdict

This article is about bank checks, how bank checks are started, and what are different types of it. Also the method of writing the check is also mentioned in this article as what you should keep in mind while writing a check.

FAQs

The crossed check is considered the safest, as it only withdraws from the drawee’s bank, and the name is also mentioned on the check with lines.

Well, according to our search, the bearer check is one of the unsafe checks as it requires less identification or requirement for withdrawal from the bank.